Understanding Exchange Money Flow

This article will help you understand how exchanges are processed in Corso and how this financial information flows into Shopify, along with some nuances of how Shopify handles and reports this data.

Original Order Sales

Section titled “Original Order Sales”Once the customer goes through checkout and pays for the order, the original Shopify order captures the initial product sales, shipping, and taxes.

| Item | Status | Price | Tax | Total | Shopify Subtotal | Order Balance |

|---|---|---|---|---|---|---|

| Product #1 | Sold | $45.00 | $3.49 | $48.49 | $45.00 | $48.49 |

| Product #2 | Sold | $69.00 | $5.35 | $74.35 | $114.00 | $122.84 |

| Product #3 | Sold | $69.00 | $5.35 | $74.35 | $183.00 | $197.19 |

| Shipping | Sold | $2.98 | $0.00 | $2.98 | $183.00 | $200.17 |

In this example, Product #1 will be returned for a refund and Product #2 will be exchanged for another product of the same value.

Refunds

Section titled “Refunds”When a product is returned and refunded, then the product is updated as Returned on the original order and the price of the product (along with its taxes) are deducted from the original order.

| Item | Status | Price | Tax | Total | Shopify Subtotal | Order Balance |

|---|---|---|---|---|---|---|

| Product #1 | Sold | $45.00 | $3.49 | $48.49 | $45.00 | $48.49 |

| Product #2 | Sold | $69.00 | $5.35 | $74.35 | $114.00 | $122.84 |

| Product #3 | Sold | $69.00 | $5.35 | $74.35 | $183.00 | $197.19 |

| Shipping | Sold | $2.98 | $0.00 | $2.98 | $183.00 | $200.17 |

| Product #1 | Returned - Refund | ($45.00) | ($3.49) | ($48.49) | $138.00 | $151.68 |

Exchanges

Section titled “Exchanges”When a product is exchanged, Corso creates a new order with the new exchange items. The new order is discounted down to $0 as to not inflate new sales numbers. The product is updated as Returned on the original order.

Shopify is limited in that there is not a connection from the original order to the new exchange order. So you will see on the original order that Shopify deducts the value of the returned product from the subtotal which also reduces the taxes of the original order.

| Item | Status | Price | Tax | Total | Shopify Subtotal | Order Balance |

|---|---|---|---|---|---|---|

| Product #1 | Sold | $45.00 | $3.49 | $48.49 | $45.00 | $48.49 |

| Product #2 | Sold | $69.00 | $5.35 | $74.35 | $114.00 | $122.84 |

| Product #3 | Sold | $69.00 | $5.35 | $74.35 | $183.00 | $197.19 |

| Shipping | Sold | $2.98 | $0.00 | $2.98 | $183.00 | $200.17 |

| Product #1 | Returned - Refund | ($45.00) | ($3.49) | ($48.49) | $138.00 | $151.68 |

| Product #2 | Returned - Exchange | ($69.00) | ($5.35) | ($74.35) | $69.00 | $77.33 |

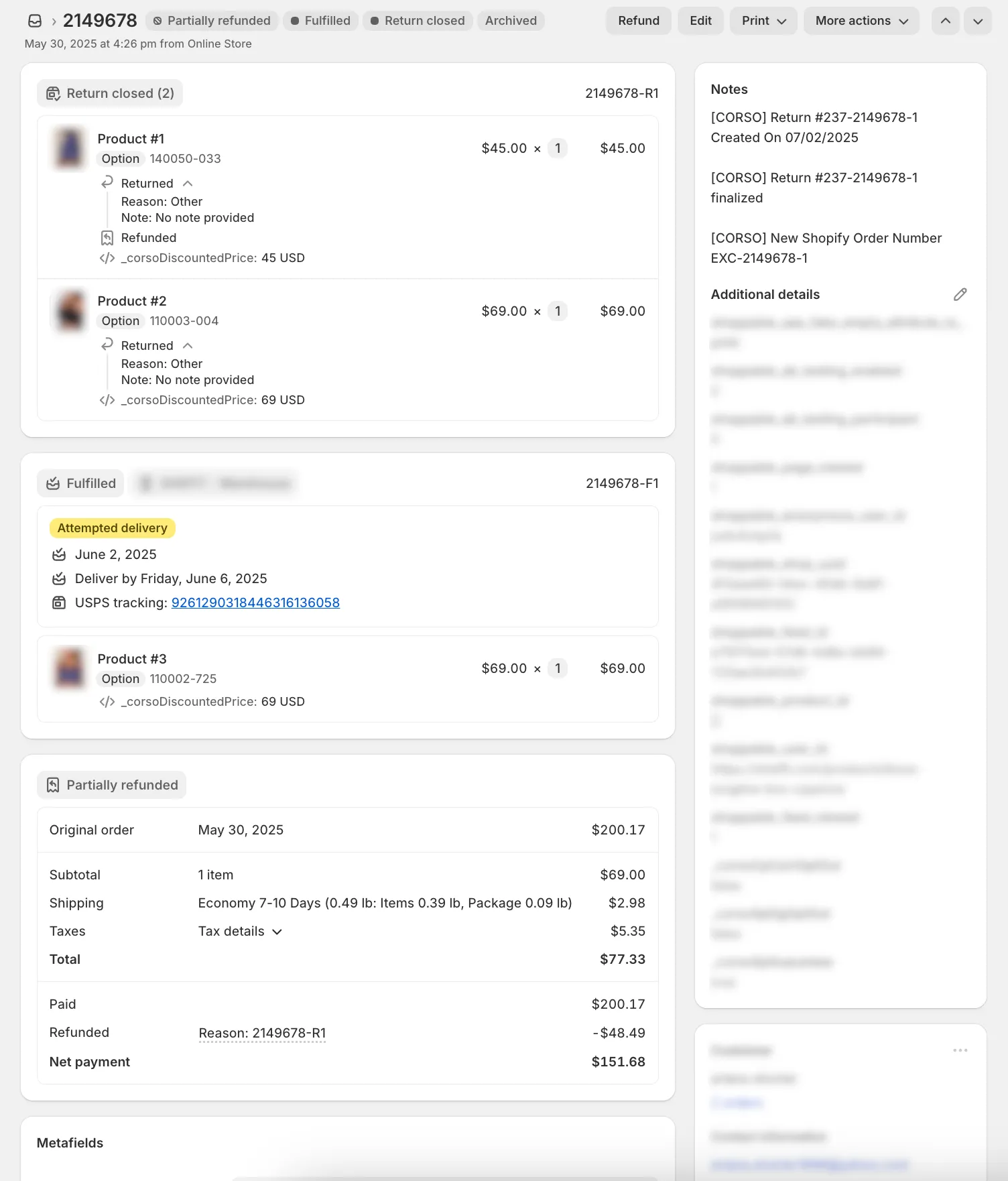

Original Order Screenshot

Section titled “Original Order Screenshot”This is a screenshot of what the original order will look like in Shopify after a claim has been finalized.

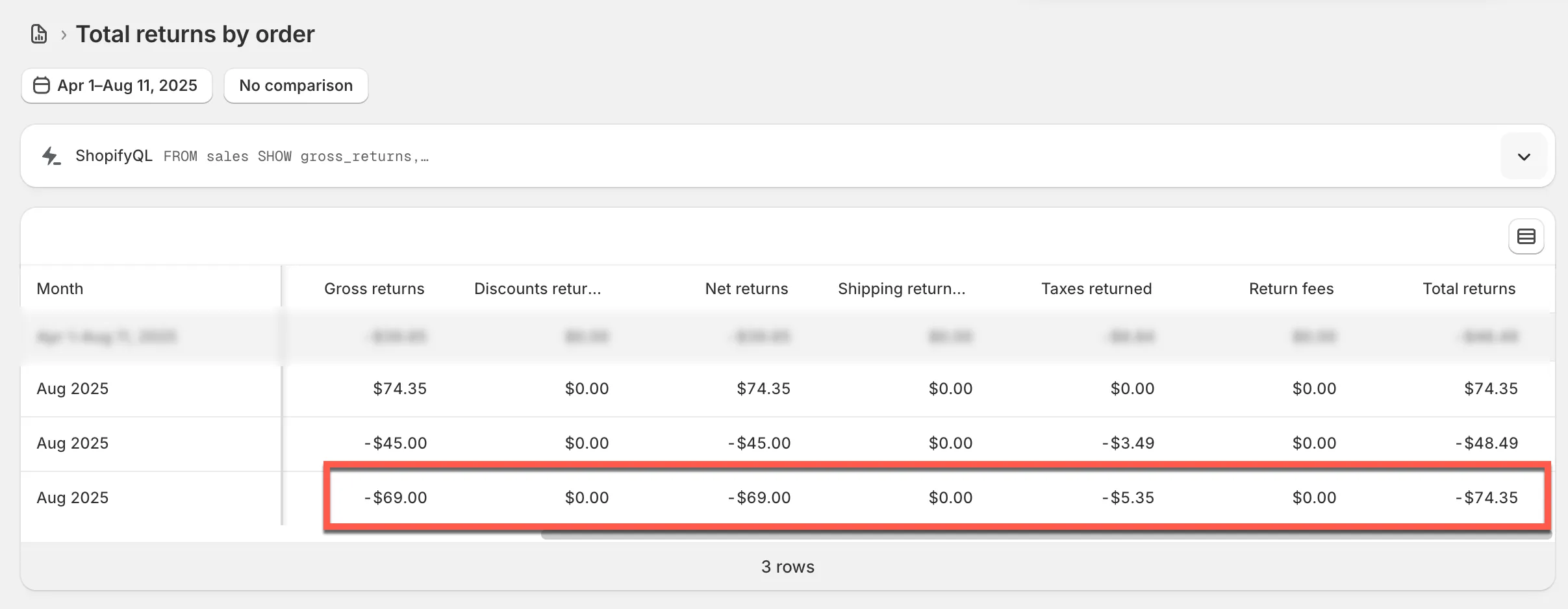

Shopify reports

Section titled “Shopify reports”Due to the way Shopify handles exchanges, you will notice in the Shopify reports that there is not a clear connection between the value deducted from the original order and the value of the new exchange order. The reports will also indicate that the tax of the exchanged item has been returned (as in, returned to the customer).

You can see this reflected in the original order as well as the Total Returns by Order report in Shopify:

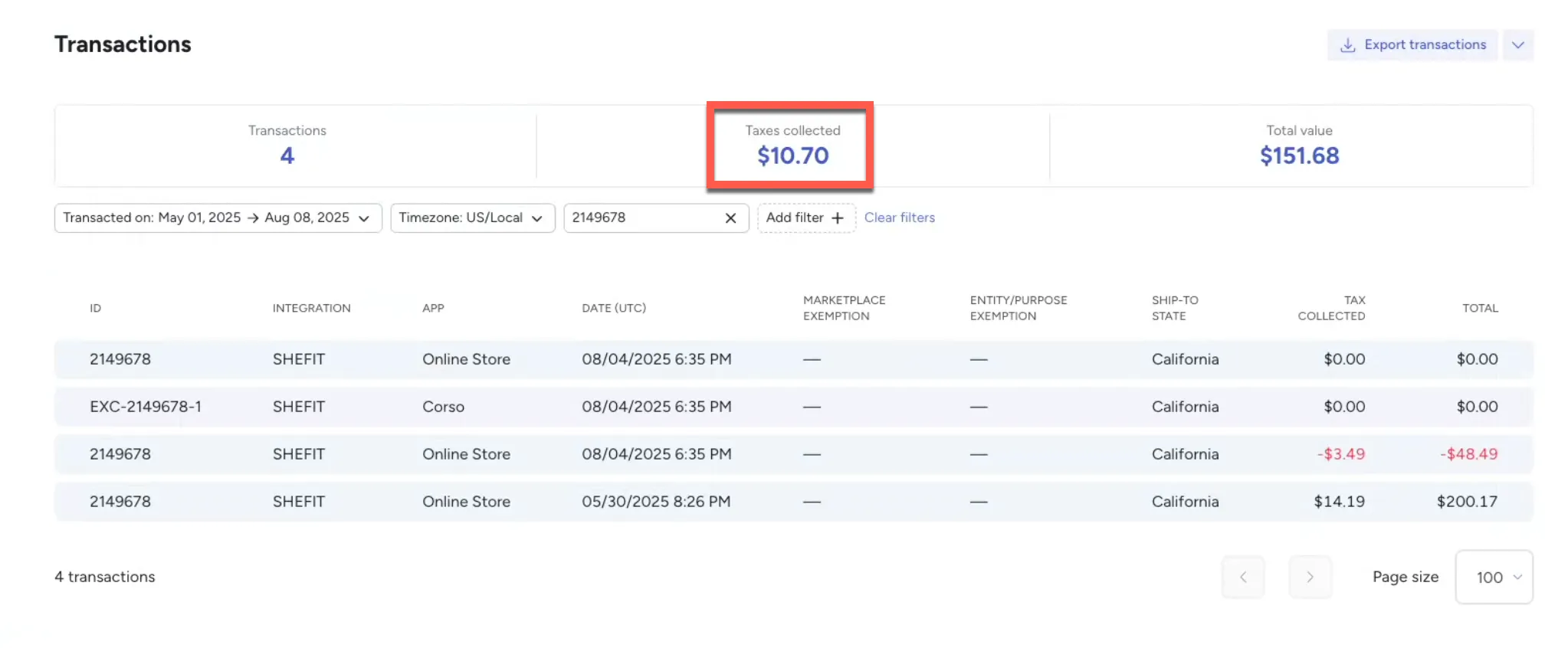

We have worked with several tax software applications and most are familiar with this scenario and handle it correctly. Before enabling exchanges, make sure that your tax application is not removing the tax from the original order on an exchange. In this example, your tax software should look something like this. The $5.35 tax of Product #3 that was kept as well as the $5.35 tax of Product #2 that was exchanged are both retained. The tax of the refund ($3.49) was returned to the customer.

Conclusion

Section titled “Conclusion”While this is not ideal for some Shopify reports, all returns applications who provide exchanges as well as tax softwares are familiar with this circumstance and can usually handle it accordingly. If you have any questions, please contact your tax software about how taxes on exchanges are managed.